Connection Card Pro Help & Documentation

Last Updated: Dec 9, 2022 3:19 PM

Creating / Recording Deposits, Donations and Income

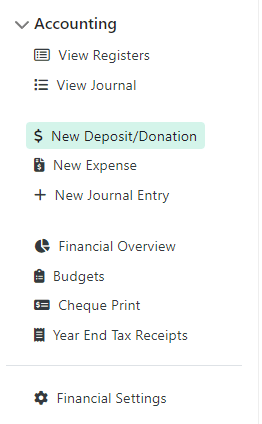

Easily track your organization's income by recording donations and deposits in the register.From the left menu, go to

Accounting > New Deposit/Donation

Selecting a Register

At the top of the page, choose which register this income record belongs to. Every deposit must be recorded in a register. Whether it is a deposit, check or transfer to a bank account (register) or a payment on a credit card (register), every income record needs a home.Below the Account Register dropdown, you will also see the current balance for the selected register.

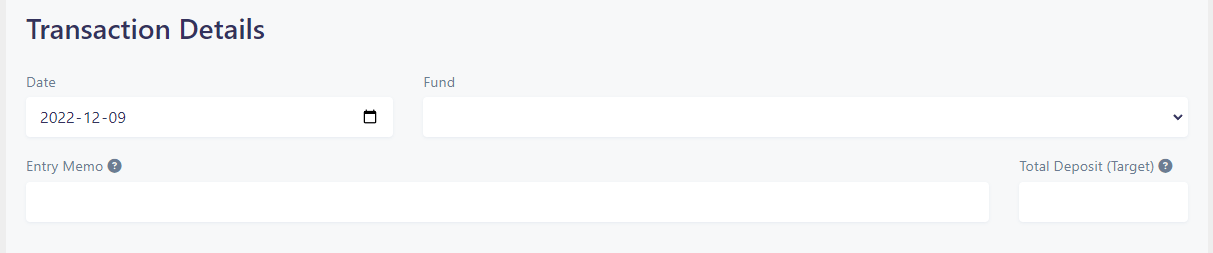

Transaction Details

- Date: (required) The date the transaction occurred

- Fund: (required) Choose which fund (ledger) this transaction belongs to

- Entry Memo: (recommended) Type a description of this transaction

- Total Deposit (target): (optional) The actual amount recorded will be calculated based on the line items. However, if you know the total already (such as a single deposit with multiple items), you may enter the total here. This will not allow you to save the transaction unless all line items equal this total.

Attach a File

You may optionally attach a file (such as receipt or statement) to this transaction for your records.Line Items

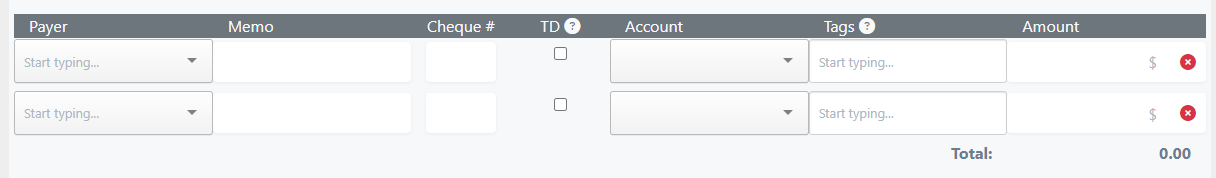

For each line item you may enter:

- Payer: (optional) You may select the donor, individual or vendor that this amount is from

- Memo: (optional) You may enter a separate description for each line item

- Check #: (optional) If this was a check you received, you may enter the check #

- TD (Tax Deductible): (optional) If this donation should be marked as tax-deductible, check this checkbox. Year-end giving tax-receipt will only include donations which are marked as tax deductible.

- Account: (required) Select an account for this line item. In most cases, you will select an Income Account. If you've received a refund from an expense you paid, you may wish to select the original expense account. If you are transferring money from another asset, you can select that asset account. Or, select a liability account if you are receiving money from a loan.

- Tags: (optional) You may choose an unlimited number of tags, such as Departments, Divisions, Projects, Purposes, Fund Raisers or Events for internal tracking of income. You may also select a custom tax classification from the tags input.

- Amount: (required) Enter the amount of this line item.

If you still have questions or require additional help, please contact our support team by clicking on the Help button > Contact Support.

Did you find this helpful?

Do you enjoy teaching, making videos, or love Connection Card Pro?

Help us fill out our Help Center with your own tutorial video! Is there an area of Connection Card Pro that you've mastered? Or some cool tricks you've discovered? Share your tutorial videos with us, if we select it to be included in our Help Center, we'll pay you $100!Submit Your Videos Here

Canadian Dollar

Canadian Dollar

US Dollar

US Dollar